OMNIS Investment Update

Posted by siteadmin on Tuesday 14th of April 2020.

Two weeks feels like a long time in markets still searching for answers about the social and economic impact of the coronavirus pandemic. On 23rd March we wrote a note entitled “There is a Path out of this”. We said Italy and other nations would be close to a peak in new case rates and this has proven to be true, even if the rate of decline has been slower than we expected. We also said this would afford markets the opportunity to rally and almost from that point stock markets have risen sharply. The key question is what happens next?

The good news is curtailing social interaction in so many countries simultaneously is having an impact on the spread of the virus, but the bad news is that it is also slowing economic activity. Over the short term, the price being paid in economic terms is eye-watering (without forgetting the human cost). Nearly 10 million Americans made a new claim for jobless benefits in the last two weeks, and the story is similar across most of the countries that have introduced some form of lockdown.

In this environment of little or no economic activity, some companies will fail, but many of those were already weak. Others will need to raise money to get them through this period, either by issuing bonds, taking advantage of existing lending facilities offered by banks or selling new shares. Dividends (payment made to shareholders out of company profits) are being cancelled to preserve cash, companies have stopped buying their own shares (which they tend to do when shares look cheap) and profits this year are rapidly declining in many sectors. However, at some point, the short-term disruption will lead to companies merging or purchasing competitors. Put simply, some companies will get too cheap and other businesses will opportunistically buy them. This should support share prices.

In markets there are always winners and losers, and the legacy of this episode will speed changes which were already going to happen. In retail, for example, even before the crisis, many businesses were suffering from the impact of online competition from the likes of Amazon, and the virus will only speed up the demise of a number household names. This can be contrasted with the extraordinary profits being earnt by food businesses such as Sainsbury’s and Tesco as they strive to keep up with the appetite of a captive audience of consumers. Airline and travel companies are obvious losers in this situation, and we think the impacts here will be far longer lasting than in other parts of the economy. Technology businesses in general will benefit as companies seek ways to improve productivity by replacing unreliable humans. The virus will cause changes in the workplace too. More people will work from home even after the movement restrictions end. There are obvious opportunities for cleaning companies, while those linked to health and wellbeing will receive a permanent boost.

Markets have rallied as new case rates started to peak in Europe, but we are far from out of the woods and the human toll will continue to rise for some time, albeit at a reducing rate. The support provided by central banks has stabilised the financial system, with measures easily surpassing the initial reaction to the global financial crisis of 2008. In the US alone, the Federal Reserve (the US central bank) is conducting as much quantitative easing (its bond-buying programme) every ten days as it undertook in 15 months between December 2008 and March 2010.

Government support has been targeted at preserving productive capacity. It probably will not be effective for everybody, but more should be on its way. Infrastructure projects, such as roads, other transport links and digital technology, seem likely areas of spending as the world tries to get back to normal. In the last few days, there have been reports of a possible $1.5 trillion package of measures in the US, and although the European Union is yet to agree a deal, the pressure is rising for some form of coordinated response. Also, the Bank of England recently announced it will directly fund some of the UK government’s extra spending. This “short-term” tactic, which effectively involves printing money to fund government spending, has been used before, but we expect it to be on a much bigger scale on this occasion. All these measures should accelerate the economic recovery.

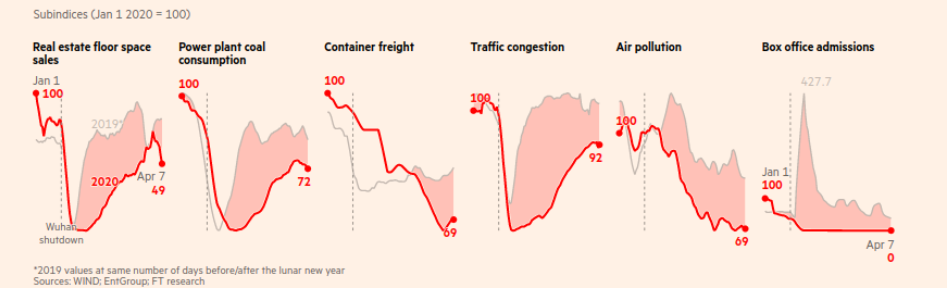

As this crisis unfolds, there will be periods of bad news and good news. Relief that we could soon see an end to the widespread shutdown has been reflected in the markets, but in the weeks before that becomes a reality, investors will have to endure bad economic and corporate news. There is also the possibility that as people begin to move around and return to work, infection rates will pick up again. The experience of China shows the return to work is not necessarily automatic. While it is hard to estimate, China’s productivity is probably back to 75-85% of its capacity, but not to the same extent across all regions or sectors (as the charts below illustrate). Do not expect China to totally return to normal until the world recovers.

There will be an economic cost from this period and markets will take time to regain their previous peaks, but there will be winners and losers among individual companies. Therefore, there are opportunities for active investment managers to differentiate their portfolios and to outperform. In the long term, we will look back at the opportunities created during this period rather than lament on permanent losses had we chosen to retreat from investing. The recession we are now experiencing is due to an event, and if we all react in the right way then the social and economic impacts will pass, and the world will recover.

Our portfolios are designed to deliver returns over a period of at least five years. Investors are usually rewarded for staying in the market for the long term. Diversified portfolios, where investments are spread across different asset classes and regions, offer further peace of mind. Finally, each client’s portfolio should reflect their attitude to risk. Portfolios with a greater proportion of shares may underperform while the coronavirus hovers over the markets, but they tend to deliver better returns in the long term. On the other hand, returns from portfolios with a higher allocation to bonds should fluctuate less in the short term.

In SUMMARY

The path out of this event will be bumpy with some businesses going bust in a number of sectors and unemployment reaching levels reflecting the shutdown of almost the entire developed world. However, central banks and governments have acted decisively, and there should be more to come. Once people return to work, these measures should help economic activity rebound sharply.

Markets may not return to their previous peaks in the short term, but they should eventually recover and reach new highs. In hindsight, investors who stuck to their principles will view this period as an opportunity.

Toni Meadows

Chief Investment Officer, Omnis Investments Limited

Issued by Omnis Investments Limited. This update reflects Omnis’ view at the time of writing and is subject to change. The document is for informational purposes only and is not investment advice. We recommend you discuss any investment decisions with your Openwork financial adviser. Omnis is unable to provide investment advice. Every effort is made to ensure the accuracy of the information but no assurance or warranties are given. The value of an investment and any income derived from it can fall as well as rise and you may not get back the original amount invested. Past performance is not a guide to future performance.

The Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC are authorised Investment Companies with Variable Capital. The authorised corporate director of the Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC is Omnis Investments Limited (Registered Address: Washington House, Lydiard Fields, Swindon, SN5 8UB) which is authorised and regulated by the Financial Conduct Authority

Please note: by clicking this link you will be moving to a new website. We give no endorsement and accept no responsibility for the accuracy or content of any sites linked to from this site.